DOWNLOAD THE GUIDE

Your Retirement Income Planning Checklist

Learn the 10 things you should consider when developing your retirement income strategy. With this instant download, you’ll discover:

- How to plan for a long life

- Why you may need a housing plan (or two)

- What taxes really look like in retirement

DOWNLOAD THE GUIDE

Four Buckets: Do You Know Where Your Tax Liabilities Fall?

What you'll learn:

- Where your current assets fall in the four tax buckets

- Why tax-deferred products could cost you later

- How to further diversify your assets — starting now

DOWNLOAD THE GUIDE

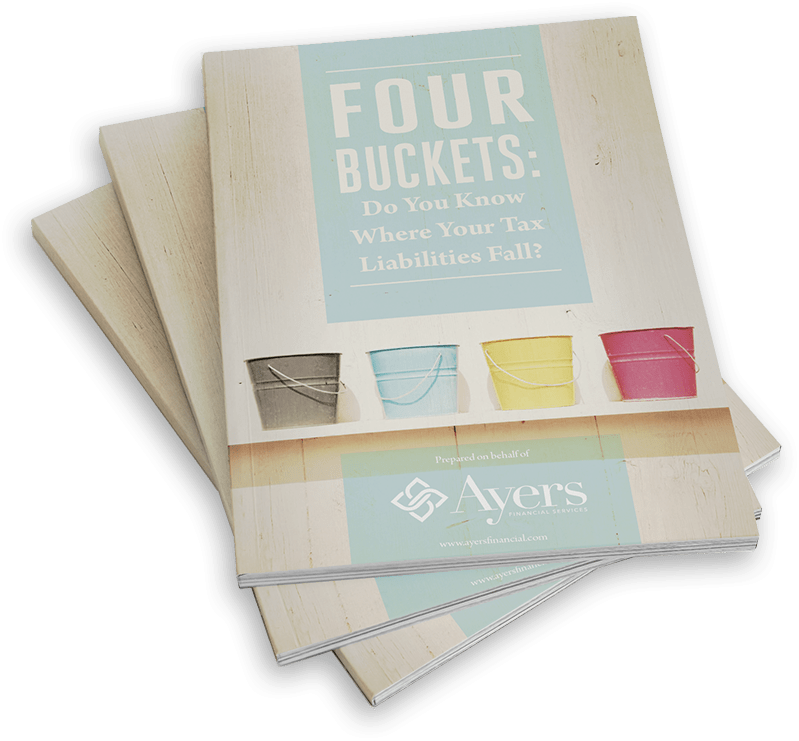

Have you done enough to confidently retire?

This 34-point checklist will help measure your retirement readiness, guiding you through some of the most pressing retirement concerns. You’ll examine:

- Whether you’re taking on an appropriate level of risk

- How your assets and liabilities stack up

- What gaps you may have in your current plan

DOWNLOAD THE GUIDE

Give your loved ones the greatest gift!

Communicating your values and wealth management goals today can help your loved ones through tomorrow. This 12-page guide can help you understand the basics of estate planning, including:

- Areas your will should address (and who should write it)

- The two types of trusts — and how they can help reduce the chance of a family conflict

- A checklist to help you select the right person to carry out your wishes

DOWNLOAD THE GUIDE

Have you considered inflation’s impact on your retirement?

Prices are increasing on everything from groceries to healthcare. Download this guide to learn more about the most common questions on inflation including:

- What causes inflation?

- Is my retirement at risk?

- Why is the rate of inflation rising?

DOWNLOAD THE GUIDE

4 Areas To Address To Help Ensure You Can Weather A Drop In The Market

This downloadable guide walks you through three things to check now to help ensure you and your family are prepared — even if the economy takes a dip. What you’ll learn:

- A simple calculation to help determine whether you've saved enough to retire

- Alternative methods to create income without relying on a volatile stock market

- The importance of planning ahead and working with a financial planning professional

*Neither the firm nor its agents may give legal advice. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation.

Ready to take

The Next Step?

For more information about any of the products and services listed here, request a meeting today or register to attend a seminar.